Harness Your First Income for a Secure Financial Future Today!

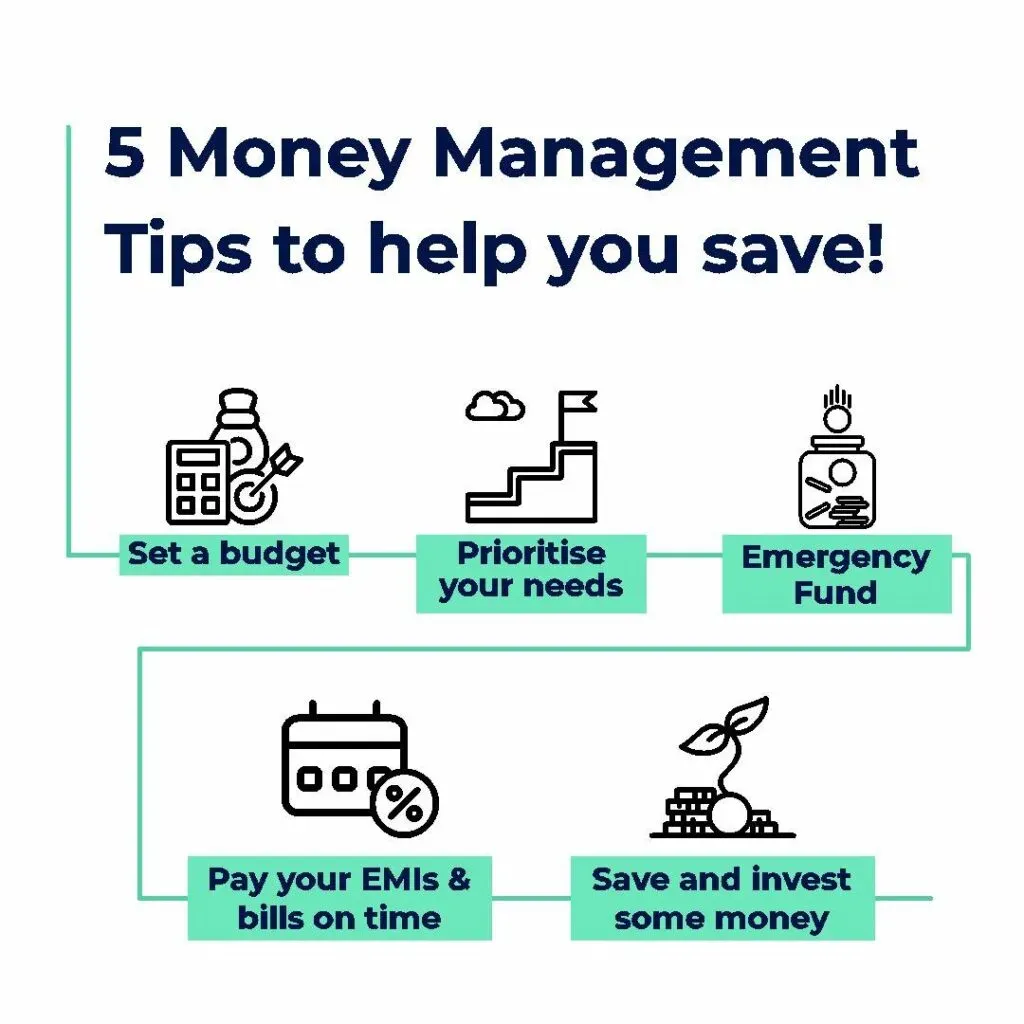

Managing your money is essential for a secure financial future, especially for young South Africans who may feel they can delay financial planning. Jessica Pillay, a financial adviser at Momentum Financial Planning, highlights the importance of starting early, saving for retirement, building an emergency fund, understanding credit, and obtaining insurance to safeguard against unexpected expenses. By taking control of their finances with informed strategies, young individuals can set a solid foundation for successful financial management and future prosperity.

The Importance of Early Retirement Savings

Early retirement savings can significantly impact long-term wealth. Starting when you earn your first paycheck allows you to benefit from compound interest, reportedly increasing your savings exponentially over time.

Many young South Africans reportedly overlook the tax benefits associated with retirement contributions. Contributions may be tax-deductible, allowing for potential immediate savings while planning for the future.

Jessica Pillay advises that the earlier you start saving for retirement, the better. “Your first income is a launchpad for financial success,” she emphasizes, highlighting the importance of proactive financial planning.

Building a Financial Safety Net

Establishing an emergency fund is essential for managing life’s unpredictability. It is generally advised to save at least three months’ worth of living expenses to cover unexpected costs.

Many young earners reportedly underestimate the value of having a financial safety net. An emergency fund can help navigate challenges like job loss or unexpected medical expenses without derailing financial plans.

Jessica Pillay advocates for young individuals to prioritize emergency savings. “No one knows what the future holds,” she notes, stressing that a financial cushion is vital for peace of mind.

In conclusion, managing your finances effectively from the start is vital for a secure future. By implementing strategies like early retirement savings, building an emergency fund, understanding credit, and obtaining insurance, you can pave the way for long-term financial stability.

Let us know your thoughts by leaving a comment below!

Don’t forget to share this article with others who may find it helpful.